![Institute of Management Studies - [IMS]](https://images.collegedunia.com/public/college_data/images/appImage/18036_1869296456f4714608e65df123bb1d89Cover.jpg?h=240&w=1000&mode=crop)

Post Graduate Diploma in Management [PGDM] (Finance) From IMS Ghaziabad, Ghaziabad

What's New in IMS Ghaziabad?

07 Nov, 2024

- The total fee of the PGDM program at IMS Ghaziabad is INR 9,50,000. Further, the hostel fee is INR 1,60,000 Per Annum.

06 Nov, 2024

- CAT 2024 will be conducted on November 24, 2024. The admit card is available now and can be downloaded from the official website, iimcat.ac.in.

| Year | 1 | 2 |

|---|---|---|

| Tution fees | ₹500000 | ₹450000 |

| Total Year Wise fees | ₹5.00 Lakhs | ₹4.50 Lakhs |

IMS Ghaziabad Upcoming Application Dates 2024

Important Events

| Events | Dates |

|---|---|

| CAT 2024 Exam Date | Upcoming Nov 24, 2024 |

| MAT (CBT 1) Registration Date | Ongoing Sep 07, 2024 - Nov 30, 2024 |

| MAT (CBT 1) Admit Card | Upcoming Dec 03, 2024 |

| MAT (CBT 1) Exam | Dec 07, 2024 |

| XAT Registration Timeline | Ongoing Jul 15, 2024 - Dec 24, 2024 |

| XAT Admit card Availability | Tentative Dec 29, 2024 |

| XAT Exam Date | Jan 05, 2025 |

| CAT 2024 Result Date | Tentative Jan 10, 2025 |

| XAT Result | Tentative Jan 15, 2025 |

| Last Date to Apply (PGDM) | Tentative Mar 31, 2025 |

Expired Events

| Events | Dates |

|---|---|

| CAT 2024 Admit Card Date | Nov 05, 2024 |

| CAT 2024 Registration Date | Aug 01, 2024 - Sep 13, 2024 |

Important Events

| Events | Dates |

|---|---|

| Last Date to Apply (PGDM) | Tentative Mar 31, 2025 |

Important Events

| Events | Dates |

|---|---|

| CMAT Registration Timeline | Tentative Mar 29, 2025 - Apr 23, 2025 |

| CMAT Admit Card Date | Tentative May 06, 2025 |

| CMAT Exam Date | Tentative May 15, 2025 |

| CMAT Result | Tentative Jun 06, 2025 |

Important Events

| Events | Dates |

|---|---|

| XAT Registration Timeline | Ongoing Jul 15, 2024 - Dec 24, 2024 |

| XAT Admit card Availability | Tentative Dec 29, 2024 |

| XAT Exam Date | Jan 05, 2025 |

| XAT Result | Tentative Jan 15, 2025 |

Important Events

| Events | Dates |

|---|---|

| MAT (CBT 1) Registration Date | Ongoing Sep 07, 2024 - Nov 30, 2024 |

| MAT (CBT 1) Admit Card | Upcoming Dec 03, 2024 |

| MAT (CBT 1) Exam | Dec 07, 2024 |

Important Events

| Events | Dates |

|---|---|

| CAT 2024 Exam Date | Upcoming Nov 24, 2024 |

| CAT 2024 Result Date | Tentative Jan 10, 2025 |

Expired Events

| Events | Dates |

|---|---|

| CAT 2024 Admit Card Date | Nov 05, 2024 |

| CAT 2024 Registration Date | Aug 01, 2024 - Sep 13, 2024 |

IMS Ghaziabad Cutoff 2024

IMS Ghaziabad, CAT Cutoff 2023

The CAT 2023 cutoff percentile for the Post Graduate Diploma in Management [PGDM] (Finance) at IMS Ghaziabad was 75 for the General category.

| Courses |

|---|

Compare |

IMS Ghaziabad, ATMA Cutoff 2023

The ATMA 2023 cutoff percentile for the Post Graduate Diploma in Management [PGDM] (Finance) at IMS Ghaziabad was 85 for the General category.

| Courses |

|---|

Compare |

IMS Ghaziabad, CMAT Cutoff 2023

The CMAT 2023 cutoff percentile for the Post Graduate Diploma in Management [PGDM] (Finance) at IMS Ghaziabad was 75 for the General category.

| Courses |

|---|

Compare |

IMS Ghaziabad, MAT Cutoff 2023

The MAT 2023 cutoff percentile for the Post Graduate Diploma in Management [PGDM] (Finance) at IMS Ghaziabad was 90 for the General category.

| Courses |

|---|

Compare |

IMS Ghaziabad Post Graduate Diploma in Management [PGDM] (Finance) Ranking

Outlook Ranking

Course Description

Post Graduate Diploma in Management Finance Top Colleges, Syllabus, Scope and Salary

Post Graduate Diploma in Finance Management is a 1-year full time postgraduate diploma course, the eligibility for which is a graduation degree in any course with an aggregate of 50% marks or above from a recognized university. It is divided into two semesters of six months each. The cut-off marks for application in this course varies from institute to institute. In various recognized universities, there are entrance tests held followed by an interview to judge the eligibility of the candidate seeking admission.

The course is best suited for those who wish to work in the banking and financial service industries such as insurance and mutual funds among others. The program, besides providing the knowledge of operational aspects of banking and finance, also builds and hones the candidate’s managerial and technical skills. Candidates seeking a job in the finance related sectors will benefit as they can gain the knowledge of the duties and responsibilities of a Financial Manager, a very important and significant position in industries in both private and government sectors.

The program offers fresh and young talents an introduction to the finance services across the sectors. Students will learn the duties and responsibilities involved in the job of a Financial Manager of an organization, enhancing their experience and expertise in the finance field. Starting from the principles and practices of management to managerial economics and management of a bank, this course is all-inclusive and well-rounded as far as the managerial and technical aspects in the financial sector are concerned.

Top Institutes offering this course are:

- Advanced Institute of Management

- Presidency College

- Bundelkhand University

- Acton Business School

- Ahmedabad Management Association

- Annamalai University

Such professionals may be hired as Bank Manager, Financial Analyst, Treasurer, Accountant, Financial Manager, Portfolio Manager, etc. in companies such as AIG (Bangalore), Boeing (Bangalore), Philips (Bangalore), JP Morgan Chase (Asset Management (Bangalore), Banks, Research Institutes, etc.

The average full time fee charged for the course in India ranges between INR 25,000 to 4 lakhs per academic year, and the average salary offered to such professional’s ranges between INR 2 lakhs to INR 15 lakhs per annum, increasing with experience and expertise.

Post Graduate Diploma in Finance Management: Course Highlights

| Course Level | Post Graduate |

| Duration | 2 years |

| Examination Type | Semester System |

| Eligibility | A graduation degree in any course with an aggregate marks of 50% marks or above from a recognized university. The cut-off marks for application in this course varies from institute to institute. |

| Admission Process | In various recognized universities, there are entrance tests held followed by an interview to judge the eligibility of the candidate seeking admission. |

| Course Fee | INR 25,000 to 4 lakhs |

| Average Starting Salary | INR 2 lakhs to 15 lakhs/annum |

| Top Recruiting Companies | AIG (Bangalore), Boeing (Bangalore), Philips (Bangalore), JP Morgan Chase (Asset Management (Bangalore), Banks, Research Institutes, etc. |

| Job Positions | Bank Manager, Financial Analyst, Treasurer, Accountant, Financial Manager, Portfolio Manager, etc. |

Post Graduate Diploma in Finance Management: What Is It About?

The course has been designed to offer the eligible students a comprehensive and well-round up curriculum on various aspects of financial management such as working capital management, international finance, and mergers and acquisitions among others. The course will help the students hone their knowledge of the duties and responsibilities of a financial manager. It will help understand the process and knowledge involved in analysing cost centre, expenses and profits of an organization, making effective balance sheets, while also understanding the aspect of minimizing cost and maximising the profit. Students will be required to possess basic managerial skills, analytical skills, and problem-solving abilities.

Even the established managers can benefit from the course by enhancing their knowledge in the financial services. The course will produce able and efficient financial managers who will be an asset to the organization they are hired in, helping it sort and figure its financial responsibilities and liabilities.

The course takes into consideration wide and varying aspects of financial management which includes the principles and practices of management, a special study of the Indian banking and financial system, capital market, management of bank, macro-economics, micro financing, and will be concluded with a project report to test the ability of the candidates to apply the theories in practical situations.

Post Graduate Diploma in Finance Management: Top Institutes

Post Graduate Diploma in Finance Management: Eligibility

Candidates wishing to apply for the course need to have completed their graduation degree with an aggregate of 50% marks or above in any stream from a recognized university. After application, an entrance test followed by an interview may be held to judge the eligibility of the candidate for the course.

| Top Finance Colleges In Maharashtra | Top Finance Colleges In Uttar Pradesh | Top Finance Colleges In Delhi | Top Finance Colleges In Tamil Nadu |

Post Graduate Diploma in Finance Management: Admission Process

Most institutes offering the course admit the students based on their performance in an entrance exam conducted by the university/college/institution. However, admission process generally varies across colleges.

A few institutes also provide direct admission based on the candidate’s performance in his/her B.A. degree.

Some such entrance tests and counselling held in the country for admission are:

- Bharthi Vidyapeeth University, Maharashtra

- Bhabha Institute of Management Science, Rajasthan

- Bundelkhand University, Jhansi

Post Graduate Diploma in Finance Management: Syllabus and Course Description

A semester-wise breakup of the course’s syllabus is tabulated here.

| Semester 1 | Semester 2 |

|---|---|

| Accounting System | Taxation (Direct and Indirect) |

| Cost and Management Counting | Financial Management |

| Financial Markets | International Finance |

| Financial Statement Analysis | Investment Management |

Post Graduate Diploma in Financial Management: Career Prospects

This course caters to the students who seek a career in the financial services industry in areas such as mutual funds, banks, and other financial sector units. An organization, no matter how big or small, national or international, will always need its financial managers to interpret and analyse the present financial status of the country which in turn shapes the financial status of the organization. They are also responsible for interpreting financial information, devise techniques to minimize cost and maximize profits. The course offers a comprehensive study of the different aspects of financial management which helps the candidate gain knowledge about the duties and responsibilities of a financial manager. It covers a critical learning of the working capital management, international finance and mergers and acquisition among others.

Such professionals, after the successful completion of the course can seek employment in both government and private sectors including banks and other such financial service units. They serve as assets to such organizations due to their enhanced skill and knowledge in financial management. Besides studying the principles of financial management, the course also delves into international finance, taxation, investment management and the likes. These candidates are expected to possess sharp logical, analytical, and problem-solving abilities to be able to sustain and thrive in the ever-growing financial market of the country and world. Even established managers can benefit from the course since it will help them gain further knowledge in the subject, allowing further promotion in their career.

A PGD degree in finance management requires the candidates to have a strong knowledge of the economic and political status and developments in the world to be able to make relevant and efficient financial decisions for an organization.

They may be hired as Bank Manager, Financial Analyst, Treasurer, Accountant, Financial Manager, Portfolio Manager, etc. In companies such as AIG (Bangalore), Boeing (Bangalore), Philips (Bangalore), JP Morgan Chase (Asset Management (Bangalore), Banks, Research Institutes, etc.

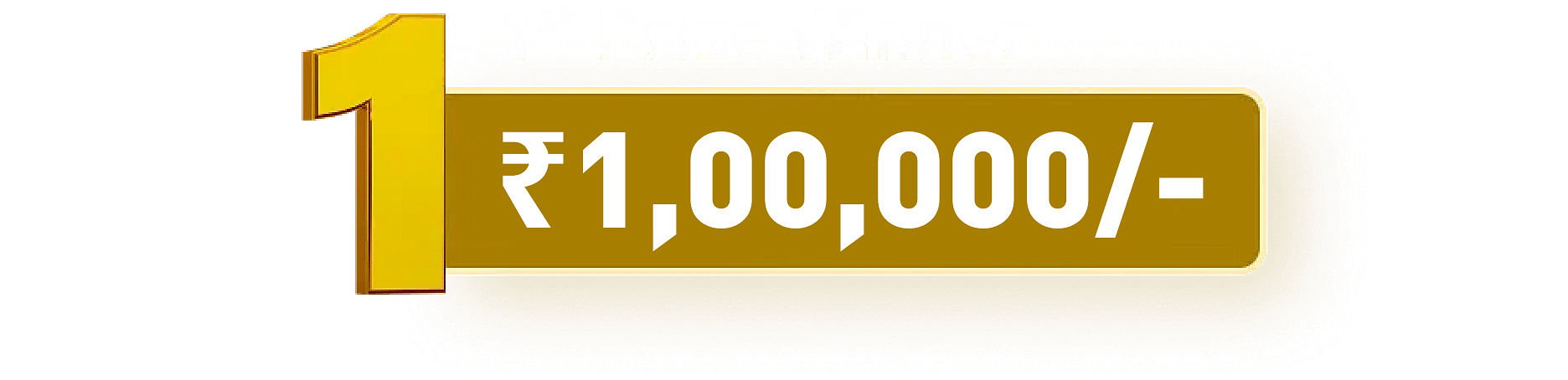

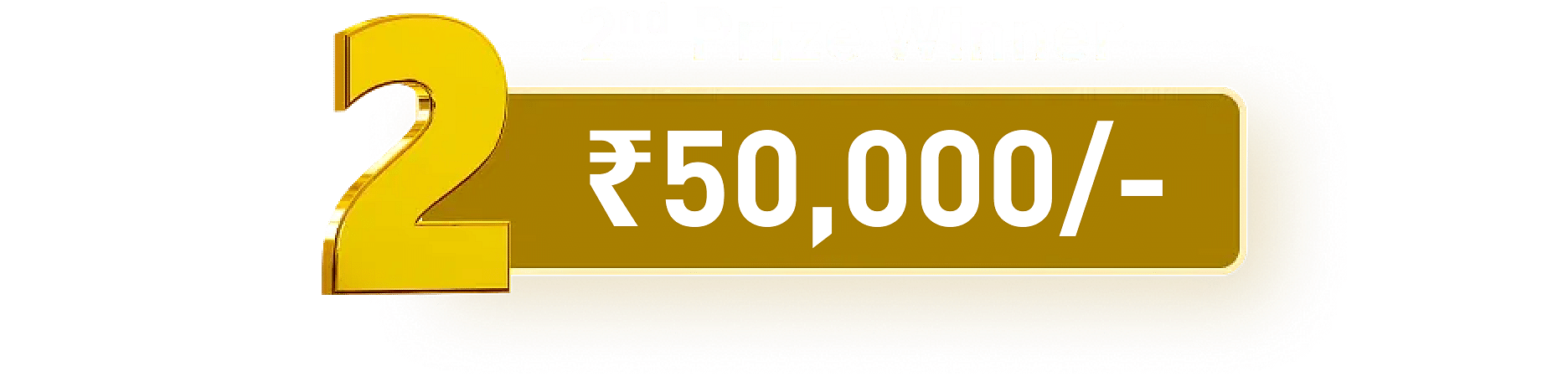

Some of the popular professional avenues open to successful graduates of the course are listed below with the corresponding salaries offered for the respective positions.

![Post Graduate Diploma in Management [Finance] annual salary](https://images.collegedunia.com/public/image/Post%20Graduate%20Diploma%20in%20Management%20%5BFinance%5D%20annual%20salary.png)

| Job Position | Job Description | Average Annual Fess In INR |

|---|---|---|

| Bank Manager | Besides receiving and dealing with customer complaints, a bank manager is responsible for overseeing the running of one or more branches and be responsible for meeting tough sales targets and keeping staff fully trained and motivated. Promoting and marketing the branch and its products is also their responsibility. | 6,23,940 |

| Financial Manager | Typical duties of a financial manager include reviewing reports of the company, monitoring accounts, and preparing activity reports and financial forecasts. They also investigate ways to improve profitability, and analyse markets for business opportunities, such as expansion, mergers or acquisitions. | 9,56,578 |

| Portfolio Manager | Portfolio managers are responsible for buying and selling securities in an investor's account to maintain a specific investment strategy or objective over time. Clients are placed into investment allocations developed or managed by a portfolio manager after suitability is established. | 12,20,838 |

Eligibility Criteria

- Applicants who have a minimum of Three year Bachelor's degree with min. 50% marks or equivalent in any discipline recognized by the UGC/ AICTE.

- Valid Test score (CAT/MAT/CMAT/XAT)

- Final Year students also apply

Course Details

Seats Intale : 360

Post Graduate Diploma in Management [PGDM] (Finance) Comparison

| IMS Ghaziabad | NDIM | IMT Ghaziabad | |

|---|---|---|---|

| Reviews Rating | |||

| Cost To Study | Total Fees ₹950000 (2 Years ) | Total Fees ₹1150000 (2 Years ) | Total Fees ₹21.53 Lakhs (2 Years ) Hostel Fees ₹84900 |

| Ranking | # Ranked 75/275 by India Today Management Ranks | # Ranked 88/125 by NIRF Management Ranks | # Ranked 11/275 by India Today Management Ranks |

| Highest Salary | ₹3500000 | ₹1200000 | ₹6560000 |

| Average Salary | ₹927000 | ₹800000 | ₹1735000 |

| General Course Details | Duration - 2 Years Course Offered - Full Time Mode - Full Time Degree Type - On Campus Course Level - Post Graduation Course Credential - Diploma | Duration - 2 Years Course Offered - Full Time Mode - Full Time Degree Type - On Campus Course Level - Post Graduation Course Credential - Diploma | Duration - 2 Years Course Offered - Full Time Mode - Full Time Degree Type - On Campus Course Level - Post Graduation Course Credential - Diploma |

| Eligibility | Graduation with 50% | Graduation | Graduation+ CAT/ XAT |

Course Finder

Search from 20K+ Courses and 35+ Streams

Popular Streams:

Why To Join IMS Ghaziabad - Reviews & Rating

Likes

- One of the finest finance faculty of finance with making toughest concept into simple ways and other faculties with refined knowledge sharing

- Many memories related to Campus and nurturing more

Dislikes

- The Campus is very small as compared to other colleges

- College should have Hostel near to Campus

Fees and Financial Aid:

When I took the admission the yearly tution fees was Rs. 330000 and admission fees was Rs.65000 . There was no category concession on the fees but their is scholarship based on entrance exam exams like CAT, CMAT, MAT, XAT,etc and secondly on the academics mark based on 10th, 12 th and Graduation more than 60 %.

Likes

- The campus is well maintained and maintain a healthy environment for students and also it has its discipline of conducting the classes and events

- Faculties are very cooperative and are always concerned about students upgradation

Dislikes

- Cons are yet not their for the campus ….

- College is having multiple pros but not any con

Fees and Financial Aid:

IMS GHAZIABAD is one of the best colleges for the students appearing for PGDM course also it has an excellent importance in the growing economy as it has all the latest updates that the students should now and expertise. Fees was paid in installment of quarterly or half yearly according to which student is capable (ie 200000 half yearly) Everything is included in the total fees of the college and the registration fees in included in the total fees which will be deducted afterwards from total fees of the course. Fees is same for all the categories of students but it differs in the application of scholarship is someone avails the scholarship Scholarship differs on various factors like marks of cat , mat , cmat and etc also your marks/ percentage of the previous courses and school

Likes

- It is a well structured and well organized Institute for the Post Graduation students.

- Enthusiastic and engaging learning enviournment created by the faculty staff.

Dislikes

- Some guidelines regarding the absence in the sessions.

- Location of the institute is not appropriate.

Fees and Financial Aid:

Tuition fee of the institute is increased by 20% in one year (2024). In 2023, it was 7.95L , now it is 9.5L. Excluding hostel charges. There are scholarships as well as quotas but that is not availed from there end till now. Currently placed in a Summer Internship Program by the Institute in Collegedunia. (Monthly stipend: 10,000)

Compare Popular Colleges With IMS Ghaziabad

IMS Ghaziabad Latest News

Institute of Management Studies, Director: Dr. Prasoon M Tripathi Interview

(1).png?h=78&w=78&mode=stretch)

Institute of Management Studies, Professor HR: Dr. Parul Yadav Interview

(1).png?h=78&w=78&mode=stretch)

Institute of Management Studies, Assistant Professor: Dr. Sushant Kumar Vishnoi Interview

(1).png?h=78&w=78&mode=stretch)

Discover More Colleges

![Jaipuria School of Business - [JSB]](https://images.collegedunia.com/public/college_data/images/appImage/16106956251490008918phpxF2wwg.jpeg?h=111.44&w=263&mode=stretch)

![Institute of Technology and Science - [I.T.S]](https://images.collegedunia.com/public/college_data/images/appImage/1502442083cscdh.jpg?h=111.44&w=263&mode=stretch)

![Ajay Kumar Garg Institute of Management - [AKGIM]](https://images.collegedunia.com/public/college_data/images/appImage/15002895261499938317Banner2.jpg?h=111.44&w=263&mode=stretch)

![Institute of Management Studies - [IMS]](https://images.collegedunia.com/public/college_data/images/logos/1728452588Untitled.jpeg?h=71.17&w=71.17&mode=stretch)

![MBA/PGDM | admission | 2024 | Institute of Management Studies - [IMS]](https://images.collegedunia.com/public/college_data/images/logos/1728452588Untitled.jpeg?h=72&w=72&mode=stretch)

![MBA/PGDM | admission | 2024 | Narsee Monjee Institute of Management Studies - [NMIMS Deemed to be University]](https://images.collegedunia.com/public/college_data/images/logos/1506323004Logo.jpg?h=72&w=72&mode=stretch)

![MBA/PGDM | admission | 2024 | Indian Institute of Management - [IIMC]](https://images.collegedunia.com/public/college_data/images/logos/1488950580d2.png?h=72&w=72&mode=stretch)

“

“

.jpg?h=90.56&w=161&mode=stretch)

.jpg?h=90.56&w=161&mode=stretch)

.jpg?h=90.56&w=161&mode=stretch)

.jpg?h=90.56&w=161&mode=stretch)

.jpg?h=90.56&w=161&mode=stretch)

![IMS Engineering College - [IMSEC]](https://images.collegedunia.com/public/college_data/images/logos/1623222389019.jpg?h=72&w=72&mode=stretch)

(1).png?h=72&w=72&mode=stretch)

(1).png?h=72&w=72&mode=stretch)

(1).png?h=72&w=72&mode=stretch)

![Noida Institute of Engineering and Technology - [NIET]](https://images.collegedunia.com/public/college_data/images/logos/1600086586Logo.png?h=72&w=72&mode=stretch)

![Institute of Technology and Science - [I.T.S]](https://images.collegedunia.com/public/college_data/images/logos/1608552249ITSLOGO.jpg?h=72&w=72&mode=stretch)

![JSS Academy of Technical Education - [JSSATE]](https://images.collegedunia.com/public/college_data/images/logos/1600838773Logo.png?h=72&w=72&mode=stretch)

![Institute of Management Studies - [IMS]](https://images.collegedunia.com/public/college_data/images/logos/1470214594140604043717_1025756_413567878759270_2077053891_o_1.jpg?h=72&w=72&mode=stretch)

![Ajay Kumar Garg Engineering College - [AKGEC]](https://images.collegedunia.com/public/college_data/images/logos/1499925698AjayKumarGargEngineeringCollege.png?h=72&w=72&mode=stretch)

![Raj Kumar Goel Institute of Technology - [RKGIT]](https://images.collegedunia.com/public/college_data/images/logos/1708607467RKGITLogoBlue1jkk.png?h=72&w=72&mode=stretch)

![Mangalmay Institute of Management and Technology - [MIMT]](https://images.collegedunia.com/public/college_data/images/logos/1645527222Untitled.png?h=72&w=72&mode=stretch)

![GNIOT Group of Institutions - [GNIOT]](https://images.collegedunia.com/public/college_data/images/logos/1670413525index.png?h=72&w=72&mode=stretch)

![KIET Group of Institutions - [KIET]](https://images.collegedunia.com/public/college_data/images/logos/1656321643KIETLOGO02.png?h=72&w=72&mode=stretch)

![Inderprastha Engineering College - [IPEC]](https://images.collegedunia.com/public/college_data/images/logos/1416639966logo1.jpg?h=72&w=72&mode=stretch)

Comments