Risk analysts, Risk managers, Risk consultants and Risk management professionals are a few designations in the growing professional fields. If you are looking to be associated with a domain like Risk consulting, Post Graduation Diploma (Level 7) in Risk Management programme is truly made for you.

In this VUCA world, the need for Risk Managers and compliance auditors has increased and today companies are looking for those competent professionals who not only have knowledge of risk related to finance, engineering, and statistics department but can also understand other multiple domains like operational, enterprise and IT. So that they can protect the prolonged goals of their customers, shareholders, creditors or the general public by mitigating emerging risks in the organization.

Who is a Risk Manager, Compliance Officer/Auditor, Chief Risk Officer or Regulatory Affairs Manager?

Pursuing a PG course in Management, Marketing, Finance or International Business has always been the top choice of students and working professionals, but what has shifted their focus towards Post Graduate Diploma in Risk Management is the diverse range of disciplines they get to work in followed by global learning opportunities and lucrative salary packages.

With the world being ambiguous and unpredictable, every organization is looking forward to dedicating a department that not only takes care of financial-related risks but risks that are uncovered in verticals like Strategy, Cyber, IT, Third-party, regulatory compliance, procurement, sales, manufacturing, distribution, etc

Risk Managers, Compliance Officers/Auditors, Chief Risk Officers, Regulatory Affairs Managers and Risks Analysts, such professionals are expected to have good problem-solving, analytical and communication skills together with negotiation and diplomacy skills and an understanding of business.

Slowly many institutions/international colleges are coming up with different courses/ programmes covering the domain of Risk as a subject. However, one such premier institute Global Risk Management Institute (GRMI) has 1 year PG in Risk management programme / International Masters in Risk Management (Level 7) that not only covers financial risk management but covers many other domains like cyber security risk management, third-party risk management, operational risk management, IT Risk Management, Strategy, Compliance, ESG, etc. It’s the only global end-to-end specialization delivered in a full-time classroom programme. GRMI came into existence in 2015 and so far with its 200 plus passed-out candidates, GRMI stands with its proud alumni from different graduate backgrounds from B.Com, BBA, B.Tech – CS, IT, Computer Science, Agri, Mechanical, Civil, BSC – Physics, Chemistry, Statistics, Food Technology, Bio-technology, Mathematics, Agriculture, BA, LLB, CA-Inter, FRM, CFA intermediate, Company Secretary to name a few. PGDRM is endorsed by the UK body -– OTHM, which is a globally accepted Level 7 Master’s in Risk Management. In addition to the GRMI Diploma students also earn International PG Diploma in Risk Management (Level 7) EQF 7 from OTHM-OFQUAL UK.

The term Risk Management not only includes reducing financial losses or protecting the reputation of an organization but also includes ensuring compliance and enhancing the decision-making of the businesses around to increase shareholder value...

Effective risk management provides organizations with a clearer understanding of potential risks and their potential impact. This can lead to better decision-making and more informed strategic planning. In short, risk management is important because it helps organizations to operate more efficiently, reduce risks and comply with legal and regulatory requirements.

With digitization in hand and upcoming development in different sectors, there are new risks that are getting highlighted, the impact of such risks is unimaginable especially when an organization loses its customers' trust due to data loss due to vulnerable IT systems and malfunctioning business practices. In addition to this, the Covid Pandemic, recent business failures and the global financial crisis have worsened the situation, and organizations are forced to establish the best risk management practices to deal proactively with any unwanted situations.

Hence this 1-year full-time PG in Risk Management programme offered by GRMI is not less than a blessing for both individuals who are looking for a diverse role in their professional career and companies who want skilled – trained risk professionals to protect them from all kinds of threats.

This programme is a full-time on-campus investment that not only focuses on case study-type understanding but pushes its students to encompass various first-hand strategies to assess and help mitigate Risks and produces the best risk-intelligent professionals. The programme covers the area of 19 subjects – Applied Data Analytics, Applied Cyber Security, Corporate Governance, Sustainability/ESG, IT Risk Management, Enterprise Risk Management, etc.

The uniqueness of such a programme is that all alumni who have been placed by GRMI have a strong bond and are very open to sharing their experiences throughout. The programme accepts students with up to 50% marks in graduation and any student from any graduation stream is applicable to sit for the program. The selection process by GRMI focuses on accepting students who have good communication skills and strong business acumen with logical thinking. Admission to this program is given based on a first come first serve policy and once the enquiry is made the highly skilled counsellors take over and guide you through the entire process.

The PG program in Risk Management is a 10-month classroom set up with the last 2 months dedicated towards internship. Up to 95% of students cover their internships in PPO and the remaining do get a chance to sit for the placement drive organized by GRMI. GRMI has met 99.5% of placements.

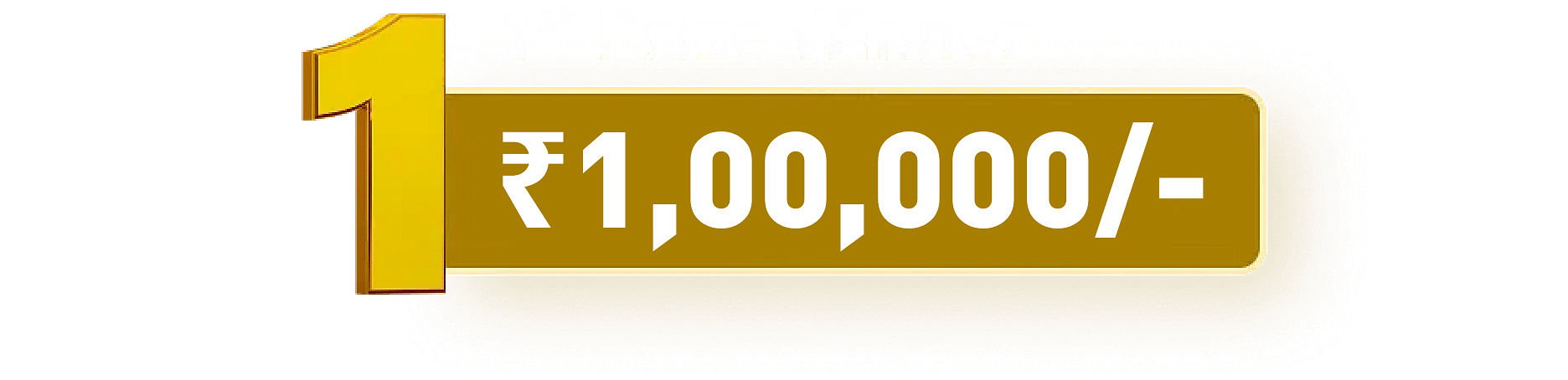

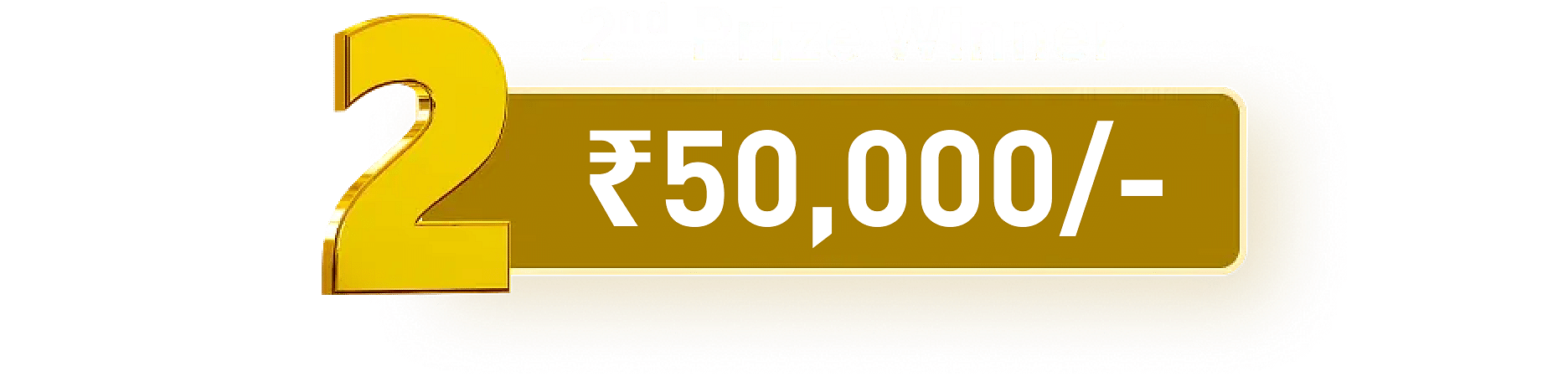

Students who are pursuing a PG Diploma course in Risk Management from GRMI have ample employment and growth opportunities. A recent placement at Global Risk Management Institute saw a whopping median package was INR 9.25 LPA. Below mentioned are some of the top recruiters of PGDRM-qualified professionals: EY, KPMG, Deloitte, PWC, Mahindra Agribusiness, Wipro, SRL Diagnostics, Protiviti, Grant Thornton, BDO, Fortis, PepsiCo, Valvoline, Zigram, Cxo-genie, Inflection, Mazars, Eicher, MGC.

Career Opportunities after Post Graduate Diploma in Risk Management

Students after completing 1-year PGDRM course can work in consulting firms as Internal Auditors, Governance, Risk and Compliance Officers, IT and Project Assurance, Enterprise Risks Managers, Strategic Consulting, Management Consulting, Technology Consulting, crises management, regulatory, Financial Risk Managers, Cloud Governance & Risk Advisory - Consultant, Quantitative Analyst, IT Audit Consultant, Financial Account Specialist, Risk Control Officer/ Manager, Risk Management Consultant, Compliance Manager or Enterprise Risk Management Consultant etc. and earn a well-paid salary.

Apart from this, professionals will get a chance to work in different departments of organizations such as Internal Audit, Governance, Risk, and Compliance, Risk Advisory / Risk Assurance Services, Strategic Risk Advisory, Enterprise Risk Management, Forensic / Fraud Investigation, Treasury Risk, Third-Party Risk Management, ESG Reporting and Information Security Risk.

Benefits of doing a job after Post Graduate Diploma in Risk Management

Aspirants and working professionals pursuing the Postgraduate Diploma in Risk Management from GRMI get abundant and wonderful opportunities and with a stable job and financial security come many benefits which they can leverage. Cited below are the details for the same.

Better Career Opportunities and Paths: There is no doubt that PGDRM will open doors of amazing opportunities for students pursuing them and the future is even more promising as companies have understood the requirement of planning and implementing the diverse range of risk management and prevention practices to safeguard their customers and business.

Secure Job and Global Networking Opportunities: Even in the uncertain time, when layoffs are happenings in almost every organization and people are thinking that where they should be applying for a new job post inflation, PGDRM holders don’t have to worry much because their demand is and will be everywhere and they can use the skills gathered during their post-graduation to grab a new job very easily and in reputed organizations.

And not only this, but professionals will also get global learning experience and work exposure after being associated with MNCs.

![Global Risk Management Institute - [GRMI]](https://images.collegedunia.com/public/college_data/images/appImage/1607422606unnamed.png?h=240&w=1000&mode=crop)

![Global Risk Management Institute - [GRMI]](https://images.collegedunia.com/public/college_data/images/logos/1598515347Logo.jpg?h=71.17&w=71.17&mode=stretch)

(1).png?h=132&w=263&mode=stretch)

(1).png?h=78&w=78&mode=stretch)

![Great Lakes Institute of Management - [GLIM]](https://images.collegedunia.com/public/college_data/images/appImage/1570797811croppedgreatlakese.jpg?h=111.44&w=263&mode=stretch)

![IILM Institute for Business & Management [IILM-IBM]](https://images.collegedunia.com/public/college_data/images/appImage/1501494596IILM.jpg?h=111.44&w=263&mode=stretch)

![BML Munjal University - [BMU]](https://images.collegedunia.com/public/college_data/images/appImage/1613293152Cover.jpg?h=111.44&w=263&mode=stretch)

![JK Business School - [JKBS]](https://images.collegedunia.com/public/college_data/images/appImage/1616659791HomeCover1.png?h=111.44&w=263&mode=stretch)

![MBA/PGDM | admission | 2024 | Narsee Monjee Institute of Management Studies - [NMIMS Deemed to be University]](https://images.collegedunia.com/public/college_data/images/logos/1506323004Logo.jpg?h=72&w=72&mode=stretch)

![MBA/PGDM | admission | 2024 | Indian Institute of Management - [IIMC]](https://images.collegedunia.com/public/college_data/images/logos/1488950580d2.png?h=72&w=72&mode=stretch)

“

“

(1).png?h=72&w=72&mode=stretch)

![Skyline Business School - [SKB]](https://images.collegedunia.com/public/college_data/images/logos/1506691000logo.png?h=72&w=72&mode=stretch)

![Indus School of Business Management - [ISBM]](https://images.collegedunia.com/public/college_data/images/logos/1572951041Annotation20191105162012.jpg?h=72&w=72&mode=stretch)

![IIMT School of Management - [ISM]](https://images.collegedunia.com/public/college_data/images/logos/1573104403IIMTSchoolofManagement.jpeg?h=72&w=72&mode=stretch)

![Amity Business School - [ABSM] Manesar](https://images.collegedunia.com/public/college_data/images/logos/1394173646n2.JPG?h=72&w=72&mode=stretch)

![Arun Jaitley National Institute of Financial Management - [AJNIFM]](https://images.collegedunia.com/public/college_data/images/logos/1648537287AJNIFMLogonew.png?h=72&w=72&mode=stretch)

![Institute of Insurance and Risk Management - [IIRM]](https://images.collegedunia.com/public/college_data/images/logos/1612283175Logo.jpg?h=72&w=72&mode=stretch)

![Luxury Connect Business School - [LCBS]](https://images.collegedunia.com/public/college_data/images/logos/1695720557Screenshot20230926145550.jpg?h=72&w=72&mode=stretch)

![Yamuna Institute of Management - [YIM]](https://images.collegedunia.com/public/college_data/images/logos/1424946031logo.jpg?h=72&w=72&mode=stretch)

![Institute for Future Education, Entrepreneurship and Leadership - [iFEEL]](https://images.collegedunia.com/public/college_data/images/logos/15931712287049496116384130596232672482600382530846720o.jpg?h=72&w=72&mode=stretch)

![Indian Institute of Learning and Advanced Development - [INLEAD]](https://images.collegedunia.com/public/college_data/images/logos/1442567741pjpjpjpp.jpg?h=72&w=72&mode=stretch)

![Budha College of Management - [BCM]](https://images.collegedunia.com/public/college_data/images/logos/1500537014logoedt.png?h=72&w=72&mode=stretch)

Comments